State-of-the-Industry Overview

Healthcare delivery in the U.S. is facing unparalleled challenges in 2022; wrestling with an ongoing global pandemic, concerns about rising inflation and staffing crises at all levels. To add to the problems, there is ongoing need for pandemic-related urgent care, a rising demand for deferred health maintenance care and uncertainty regarding changes to patient caseloads. All of this has contributed to making long-term planning exponentially more difficult than in the past. To survive in the volatile, competitive healthcare arena today, providers need to seek out creative and innovative solutions that increase efficiency without compromising their standards of care. In the face of these daunting challenges, health systems, physician practitioners, and other providers are rethinking their approach to capital investment and real estate strategies.

The 2022 annual survey by the American College of Healthcare Executives*, once again finds financial operations among the top concerns of healthcare administrators. Cost containment strategies are seen as vital to ensuring long-term viability and decisions related to facilities and real estate are some of the key components of those financial strategy discussions.

This white paper will uncover methods and best practices to unlock new options that enable future growth and expansion by deploying financial resources in the most cost-effective and efficient ways.

Facility Distribution and Continuum of Care

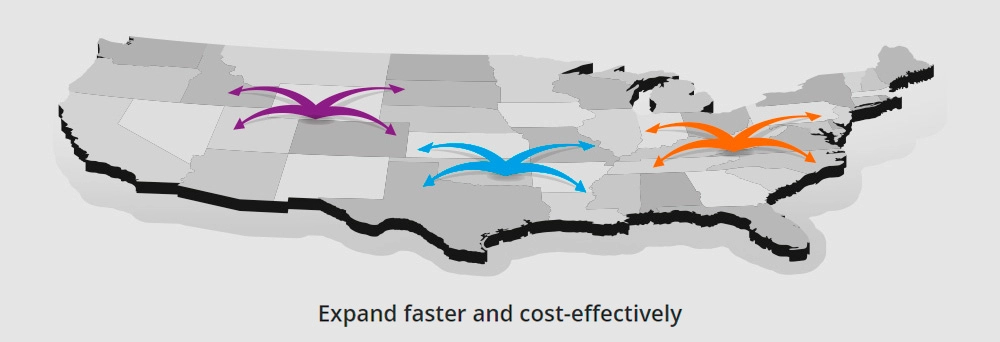

Ambulatory care takes place across a continuum of healthcare service providers in order to address the myriad medical concerns that may arise in the course of a human lifespan. An analysis of medical facilities within a community shows a natural tendency among providers to locate their offices near a major local hospital or healthcare system facility, creating satellite clusters of care providers within a community. By collocating provider facilities within a specific geographic setting, healthcare systems can deliver care within a community more efficiently and also respond faster to changes in demand by adding providers or services. However, this model has enormous implications for local medical facility administrators, care providers and patients.

For facility administrators and providers, the practice of locating near other provider facilities makes intuitive sense. One unfortunate side effect is that densely packed medical offices can limit the potential to grow or expand services without relocating, potentially outside the cluster. That’s not only expensive, but can also be counterproductive if it means losing patients. Moving a significant distance outside the local cluster, may negate the factors that led to the need to move in the first place.

Another problem for communities is that this consolidation of services into a small area can create huge gaps in coverage for patients who live outside those areas, leaving some communities drastically underserved by providers and requiring patients to travel long distances to find the care they need.

Mitigating the Impact of Geographic Collocation on Practice Growth

The role of real estate in healthcare delivery is often overlooked – at least until it becomes a problem. A better strategy is to move away from a crisis-management mentality regarding real estate decisions towards a more proactive and strategic model based on long-term, goal-oriented planning. This approach leads to more financially sound, data-driven real estate planning that delivers better outcomes for patients and solid financial returns.

Medical real estate, at its core, is about providers and their ability to serve their patients. Fluctuations in patient load and demand for services are inevitable, but administrators can easily spot predictive indicators that long-term facility needs are evolving.

Historically, it has been common for a healthcare provider to, wholly or in part, own the building in which they practice and lease out excess space to other providers, potentially placing them in conflicting roles as provider, tenant and landlord. This dynamic, along with the significant financial commitment the real estate itself represents, can make objective decision-making impossible and stifle innovation.

KEY INDICATORS OF A NEED FOR FACILITY CHANGE/UPDATE

● Are patients repeatedly complaining about a lack of parking?

● Are there long wait-times at patient check-in?

● Is there demand, but you are unable to accommodate new patients or add providers?

● Are there unmet needs within the community that could be answered by more providers or services?

● Is site security an issue?

● Are unexpected capital expenditures dragging down your financial operations?

● Are short-term, recurring expenses preventing investment in future growth?

However, there are financial strategies that can remove these barriers and expand the options for facilities improvement through investor partnerships. In fact, according to a survey by the Ryan Companies, published in the July 12th, 2002 on GlobeSt.com, 75% of healthcare companies recently surveyed say they’re considering leasing instead of owning commercial real estate, lured by the promise of more flexibility as COVID-19 continues to wreak havoc on decision making.”

Capital Strategies to Remove Barriers to Expansion

One roadblock that healthcare administrators face in the traditional model of provider-owned and managed real estate is that many diverse – and sometimes opposing – factors have to come together and be resolved at exactly the right time in order to implement change. To compete in today’s fast-paced world of commercial real estate requires quick decisions regarding transactions that can involve large amounts of capital expenditure. The inability to access the needed financial resources in a timely fashion can lead to compromises to a strategic plan that can negatively impact the long-term goals of the practice.

During uncertain times, selling medical office space with an option to lease back makes perfect sense; it frees up capital for other uses, transfers risk to the investors, and allows practitioners to expand their practices to meet rising demand. A sale/lease back strategy can also be an attractive way to take advantage of the current Sellers’ market when contemplating moving, retiring or transferring ownership of a practice in the near future.

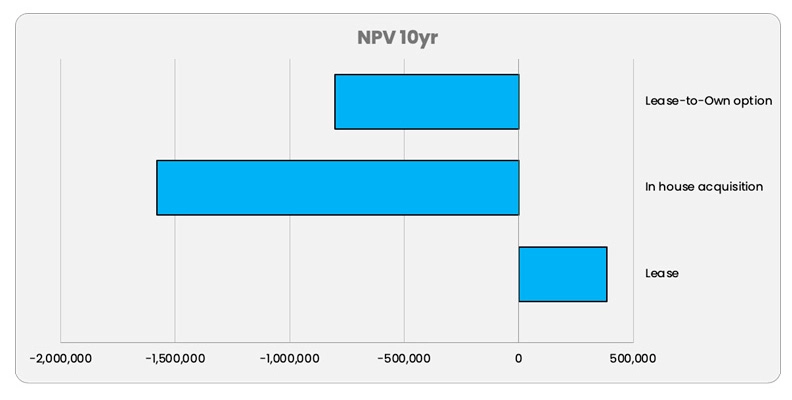

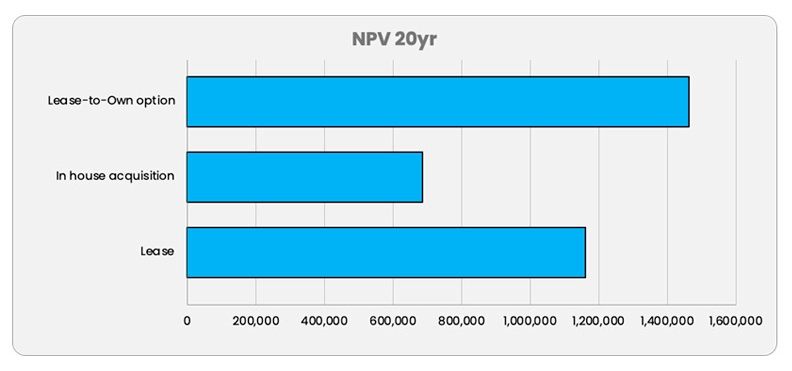

As illustrated in the following charts, after the initial outlay of capital needed to purchase a medical office building, the lease option outperforms the in-house acquisition after ten (10) years; and most likely also after twenty (20) years, accounting for extra running costs, capital expenditures, and fit-out upgrades due to age and wear & tear of the facilities. At 20 years post-purchase, leasing still seems to perform better than the other options while getting rid of the initial financial commitment.

It’s not surprising then that many healthcare providers are rethinking their long-term real estate strategies and considering investor partnerships. By leasing with a long-term strategic capital partner, they retain control of the property while facilitating the delivery of essential healthcare in communities with more flexibility and fewer headaches.

About MM2

MM2 is a commercial real estate investment company exclusively focused on healthcare with a mission to advance access to care to every person through real estate. MM2 is committed to investing in long-term relationships that serve healthcare providers, patients and communities.

At MM2 we partner with health systems and practitioners and provide financial resources to buy and update medical space, thereby removing or reducing barriers to care.

- Custom end-to-end real estate acquisition and management support

- Streamlined transaction / contracting process

- Niche real estate expertise in ambulatory office space

- Standard operating model to support ambulatory growth at scale

- Greater flexibility / bargaining power in the real estate marketplace

- Single Master Lease Agreements across multiple buildings

Published February 4, 2022 at American College of Healthcare Executives “Top Issues Confronting Hospitals in 2021”.